3D Secure (3-Domain Secure) is a security protocol used by major credit card networks to provide an additional layer of protection for card-not-present transactions. While the system is designed to reduce fraud and increase payment security, many users occasionally encounter a frustrating message: “3D Authentication Failed”. Understanding what this error means and how to fix it is crucial for seamless online transactions and maintaining cardholder trust. In this guide, we break down what causes 3D authentication failures and how to resolve them.

TLDR

3D Authentication Failed errors typically occur due to issues with card issuer verification systems, outdated browser settings, or incorrect personal credentials. To fix the issue, ensure you’re using an updated browser, check with your card issuer, and confirm your contact details are correct. If the problem persists, consider using an alternative card or payment method. Most issues can be resolved with a few quick steps to align your device and billing information with your bank’s authentication process.

What is 3D Secure Authentication?

3D Secure (Three Domain Secure) is an online credit card payment authentication method developed by Visa (Verified by Visa), MasterCard (MasterCard SecureCode), and other card networks. It works by sending an extra step in the verification process, such as a one-time password (OTP), biometric approval, or a security question, to confirm that the user initiating the transaction is the actual cardholder.

This protocol creates three domains involved in the authentication process:

- Issuer domain: The bank that issued the card.

- Acquirer domain: The merchant or payment processor.

- Interoperability domain: The infrastructure (like Visa or MasterCard) that connects both.

Why 3D Authentication Can Fail

A failed 3D Secure authentication error usually stops you in your tracks during checkout. There are several common reasons this might happen:

- Incorrect personal security credentials: Typing the wrong OTP, password, or failing biometric verification.

- Outdated browser or app: Older browsers may not support the script or pop-up windows required.

- Bank system error: Sometimes, bank servers are down or undergoing maintenance.

- Incorrect contact details: If your registered phone number or email has changed, you might not receive the code.

- VPN or restricted device usage: Banks might block verification on unfamiliar locations or devices.

How to Fix a 3D Authentication Failed Error

If you’re receiving the “3D Authentication Failed” message, don’t panic. Here are steps to troubleshoot and resolve the issue effectively.

1. Verify Your Contact Details with the Bank

Most 3D authentication methods rely on sending a One Time Password (OTP) to your registered email or mobile number. If those details are outdated, you won’t receive the code or prompt for approval. Contact your bank’s customer service or log into internet banking to:

- Confirm your phone number and email are accurate

- Update outdated contact information

- Test receiving OTPs by attempting a small transaction

2. Clear Cache and Use an Updated Browser

If your browser is outdated or corrupted by saved sessions and cookies, the 3D Secure transaction page might not load correctly. Cleaning up your browser’s cache and updating it is a simple yet effective fix:

- Clear browser cache, cookies, and site data.

- Ensure JavaScript is enabled and pop-ups are allowed.

- Use modern browsers like Chrome, Firefox, or Safari with the latest update installed.

3. Disable VPN or Proxy Connections

Using VPNs or anonymous proxy servers can trigger suspicious activity flags from your card issuer. As a result, the 3D authentication system might block your attempt as a security precaution. Try the following:

- Disconnect from your VPN service temporarily.

- Try making the purchase from a known IP address or your home network.

- Use the device you’ve previously used for successful transactions.

4. Try a Different Device or Browser

Sometimes, the issue is specific to a device or browser due to missing plugins or scripts. If you continue to face issues, switch to a different computer, smartphone, or web browser and attempt the transaction again.

5. Confirm Your Participation in 3D Secure

Depending on your bank, 3D Secure might not be automatically active on your card. Many banks require manual enrollment:

- Log in to your bank’s internet or mobile banking portal.

- Look for sections such as “Manage Security” or “3D Secure Settings.”

- Register your card for 3D Secure or confirm activation.

Also note that some banks offer biometric verification (face recognition, fingerprint), so make sure your phone or banking profile has that functionality correctly enabled.

6. Contact Your Bank’s Support

If none of these steps solve the issue, contact your bank’s customer service. Provide them with the full details of the failed transaction and ask if there are any fraud filters, regional restrictions, or outages affecting your card.

Some questions to ask:

- Is there maintenance going on with the 3D Secure servers?

- Could the transaction have been flagged as suspicious?

- Is there a limit or block on international or high-value transactions?

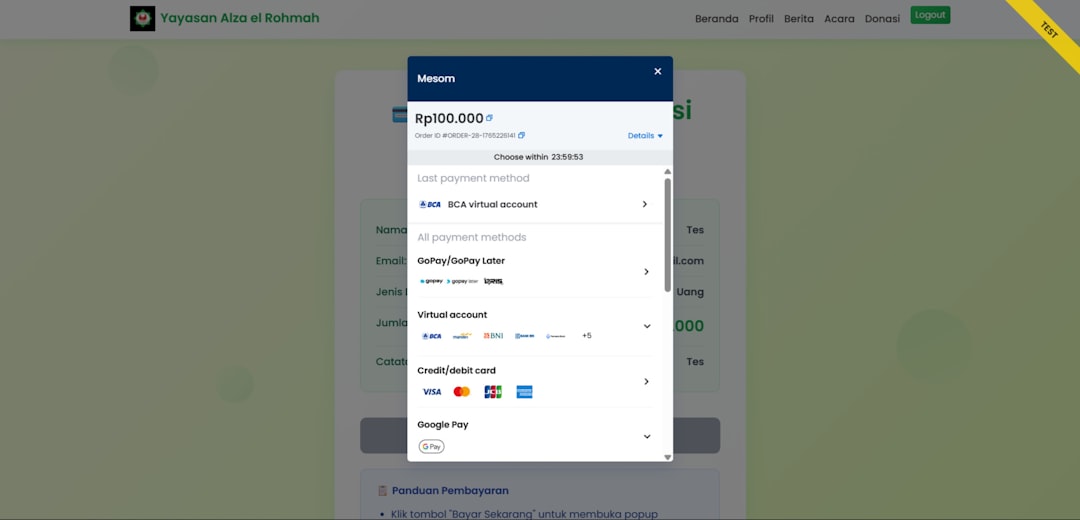

7. Consider Alternative Payment Methods

If the issue is urgent and needs an immediate resolution, use another payment method:

- Try using a different credit or debit card with 3D Secure enabled.

- Use platforms like PayPal, Apple Pay, or Google Pay which may bypass traditional 3D Secure steps.

- For recurring issues, consider switching to banks known for smoother 3D Secure infrastructures.

How Merchants Can Handle 3D Authentication Failures

For merchants, 3D Secure failures can result in dropped sales and poor customer experiences. Here are tips for helping your customers:

- Provide clear error messaging: Let the payer know how to fix the issue or whom to contact.

- Offer multiple payment gateways: Some gateways have better authentication success rates than others.

- Allow guest checkouts: This avoids unnecessary friction during the checkout process.

- Monitor failed transactions: Proactively follow up with customers whose payments didn’t go through.

Conclusion

3D Secure is a vital tool for reducing online payment fraud, but when it malfunctions, it can create unnecessary stress and lost sales for consumers and merchants alike. Resolving a failed 3D authentication often involves verifying your contact information with your bank, updating your browser, or contacting support for further help. Following the steps outlined above should fix the issue in most cases and allow you to enjoy a safe and uninterrupted online shopping experience.

Remember, staying proactive and maintaining updated personal and device information will go a long way in ensuring smoother future transactions. If issues persist beyond your control, consider escalating with your bank or exploring other trusted payment options.